TTM Technologies, Inc.

We approach investment opportunities with the goal of working together to facilitate the needs of the owners, the company and its management team.

When the founder and CEO of Pacific Circuits decided to pursue financial liquidity and seek retirement, we, in concert with another financial sponsor, structured a transaction to meet the seller’s objectives and provide for management succession. We recruited Kent Alder, an industry executive with a distinguished background and a prior relationship with the principals of Brockway Moran & Partners, as CEO. Building on previous industry experience, a strategy was designed, calling for greater customer and end-market diversification and an emphasis on technological leadership.

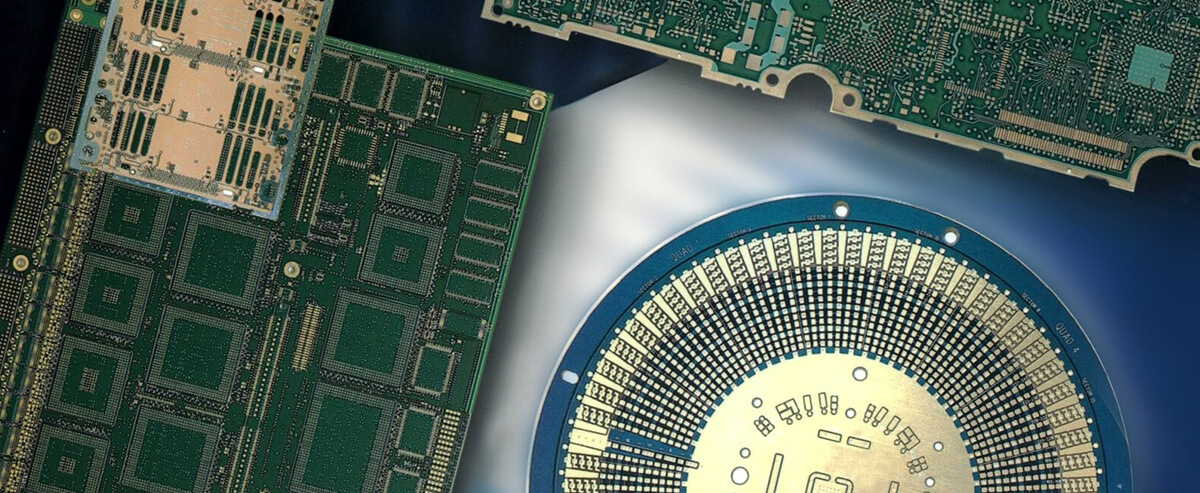

Pacific Circuits made substantial progress in meeting these goals both internally and through the acquisition of Power Circuits, a leading quick-turn operation targeted at the time of our investment as an attractive acquisition candidate. The combined companies were renamed TTM Technologies to reflect “Time-to-Market”, a critical aspect of new product development which was increasingly important to customers due to shortening product life cycles. TTM Technologies completed an initial public offering enabling the company to pay down a substantial portion of the debt incurred in the buyout and providing a liquidity event.

Over the subsequent three-year period, approximately 40% of the printed circuit board industry’s capacity was removed due to the most severe downturn in technology spending ever. Despite this, TTM Technologies remained profitable each quarter and capitalized on its strong industry position with the purchase of Honeywell’s Advanced Circuits division. When the technology markets rebounded, the company emerged as the leading “one-stop” provider of time-critical and technologically advanced printed circuit boards in the industry. TTM Technologies’ liquidity and public float were further strengthened by four successful secondary stock offerings, through which Brockway Moran & Partners sold its remaining interest.

Brockway Moran & Partners’ investment in TTM Technologies represents a great example of the win-win outcomes we work to achieve for all concerned. That’s the goal we bring to every transaction. It’s a goal that has been met over and over.

Print