Tri-Star Electronics International, Inc.

Who says that sequels aren’t better than the original? We are a relationship-driven firm and believe that partnerships with great managers can lead to great results if there is a shared vision and culture. We partnered with an exceptional CEO, Mark Silk, for a second time with our acquisition of Tri-Star Electronics and, while the original partnership with Mark was terrific, the second turned out to be even better.

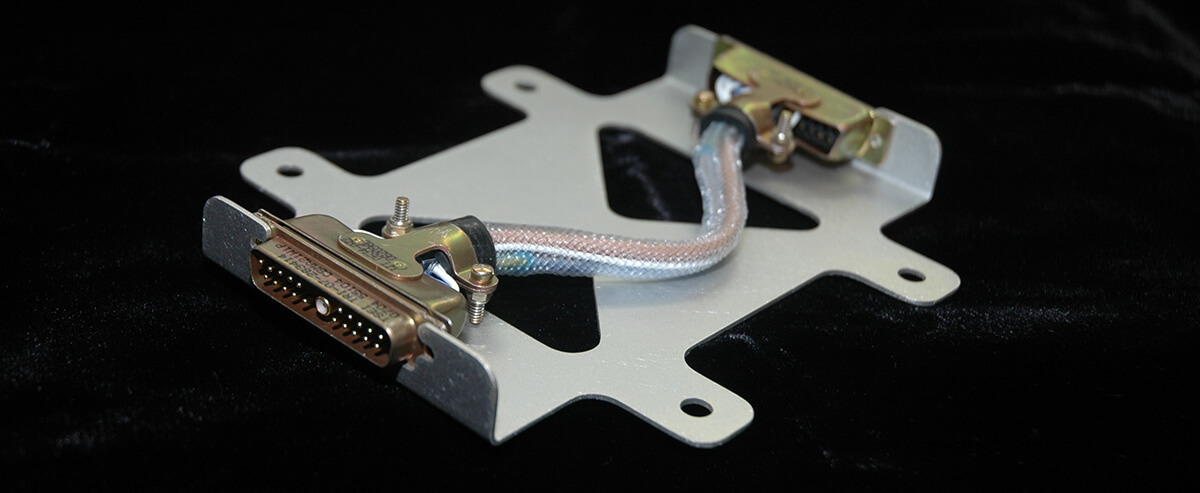

Tri-Star is a leading provider of electronic interconnect components for commercial aerospace, defense and industrial applications, and is widely recognized as the premier supplier of high-reliability contacts. During Brockway Moran & Partners’ nearly five-year ownership period, Tri-Star accomplished a number of strategic initiatives that significantly enhanced its competitive position and improved the business. The company invested in proprietary equipment and processes, consolidated facilities and reorganized production, and fostered a culture of continuous improvement. Simultaneously, Tri-Star grew its market share, gained Airbus as a significant customer and broadened its distribution to mid-tier connector makers, distributors and value-added resellers. All of this was done even as the company faced some challenging times as it was impacted by an extended Boeing machinist strike and the severe economic downturn.

After navigating the choppy waters associated with the global economic recession and accomplishing all the objectives discussed above, Tri-Star was sold to Carlisle Companies Incorporated, a public, global diversified manufacturer serving a broad range of end markets including aerospace and electronics, for a purchase price multiple that was significantly greater than the one at initial acquisition. This multiple arbitrage reflected the significantly stronger business with increased market share and growth prospects, higher quality cash flows, stronger customer relationships and dramatically improved margins that was created through the partnership with a strong CEO like Mark Silk and a private equity firm that provides much more than just capital.

Print